I recently received a few emails that dealt with America’s mounting debt crisis and other economic issues. I took a few of those emails and restructured and rewrote them a bit into the following post. It attempts to explain the financial mess our country is in and how it got there. I hope you will take a look at it.

We are hearing a lot these days about things like the debt ceiling, Treasury bond auctions, the growth of the Federal Reserve balance sheet, a decline in asset value, escalating capital gains taxes, and an upturn in the corporate tax rate.

For many people, it all sounds like a lot of economic mumbo-jumbo, and many folks believe it really has no impact on their lives.

Those people would be VERY WRONG!

The “useful idiots” in Washington DC are playing a dangerous shell game with our economy and in turn, the economic well-being of every working American.

For example, the useful idiots in Congress (mostly Democrats) are legislating more and more spending and paying for their vote-buying largess by having the U.S. Treasury sell Treasury bonds and notes in order to fund their rampant spending spree.

And who is buying those T-bills? The good old Federal Reserve, that’s who.

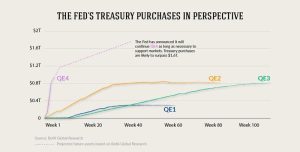

The Fed buys all of the bonds at each treasury auction that non-government investors are unwilling to buy in a quantity adequate to keep interest rates low. How is the Fed paying for those T-bills? Why, with dollars that are essentially created out of thin air, that’s how.

That bit of economic voodoo has resulted in the growth of the Federal Reserve balance sheet at a +15% rate in recent years with no slowdown in sight. This enfeebles the U.S. dollar and that means if our assets (real estate, equities, fixed assets, hard assets, etc.) are not appreciating at a rate above +15% – ALL OF US LOSE!

Not satisfied with that bit of sleight of hand, our government also pilfers a sizable portion of most asset gains by taxing all gains – WE LOSE AGAIN!

Japan has been playing this shell game for decades and with some success because more than 90% of Japan’s sovereign debt is held by its citizens. For some reason, Japanese citizens still trust their government and to a great extent, unfortunately, so do their American counterparts.

Hang on. I’m not finished yet. There’s more.

Because the American dollar is the world’s reserve currency, a lot of U.S. sovereign debt is held by foreign nations (see table below). That means the FED’s current financial shell game is placing the trillions of dollars back into the hands of ANYONE holding U.S. dollars or U.S. dollar-denominated assets.

So what? you may ask. Why should any of that economic wheeling and dealing concern me?

How about this for a reason to be concerned. As the dollar weakens under the weight of unsustainable debt, the value of your house, your social security, your pensions, your annuities, your life insurance, your IRAs, etc. weaken right along with that limp and sagging dollar.

And that, my friends, means an uncertain financial future for all of us.

So here is the question of the day: Why are we willing to allow our devious and undependable political class (with very few exceptions) and their deep state masters to destroy our future at this exponential rate?

And here is another question. Is there anyone on the horizon who might alter this precarious economic trajectory before it’s too late?

Hmm. Let me see. Nope, I don’t see anybody out there

Okay, now here’s another way to look at what I just said. Please bear with me.

I will break it down into two lessons.

Lesson # 1:

* U.S. Tax revenue: $2,170,000,000,000

* Fed budget: $3,820,000,000,000

* New debt: $1,650,000,000,000

* National debt: $19,271,000,000,000

* Recent budget cuts: $38,500,000,000

I know. All of those zeroes are daunting and frankly, they give me a headache.

So let’s remove 8 zeros and pretend those trillions and billions and millions are part of a household budget. That will make it all seem much more fathomable.

* Annual family income: $21,700

* Money the family spent: $38,200

* New debt on the credit card: $16,500

* Outstanding balance on the credit card: $192,710

* Total budget cuts so far: $385

Got It? Good. That’s how the useful idiots in Congress and the White House are spending our tax dollars, managing our budget, and escalating our exponentially increasing debt by raising the Debt Ceiling.

OK now for Lesson # 2 (The Debt Ceiling):

Here’s another way to look at the Debt Ceiling:

Let’s say, you come home from work and find there has been a sewer

backup in your neighborhood. Your home now has sewage all the way up

to your ceilings.

What will you do?

Raise the ceilings, or pump out the crap?

Your choice is coming in November 2022. I hope you make the right one!